Understanding the Basics of Medicare Plans

Medicare is a federal health insurance program for people aged 65 and older, certain younger individuals with disabilities, and those with End-Stage Renal Disease. It comprises several parts, each offering different types of coverage. Part A covers hospital services, including inpatient care, skilled nursing facility care, and some home health care. Part B covers medical services like doctor visits and outpatient care. Part C, also known as Medicare Advantage, is an all-in-one alternative to Original Medicare provided by private insurers. Part D covers prescription drugs. It is important to review your healthcare needs annually to ensure your chosen plan still aligns with your requirements. Understanding these parts is crucial as they provide a foundation for selecting a plan that best meets your healthcare needs.

Key Differences Between Medicare Parts A, B, C, and D

Medicare Parts A, B, C, and D each provide distinct services, making it essential to comprehend their differences. Part A, primarily for hospitalization, is typically premium-free if sufficient work credits have been earned. Understanding these differences can help beneficiaries make informed choices about their healthcare coverage. It is important to review these options annually, as plan details and personal health needs may change. Part B requires a monthly premium and focuses on outpatient care and preventive services. Part C, or Medicare Advantage Plans, bundle Part A and Part B, often including Part D, and offer additional benefits through private insurers. Part D exclusively covers prescription drugs and requires an additional premium. Each part has unique offerings and limitations, affecting how individuals access and pay for healthcare.

Evaluating Costs: Premiums, Deductibles, and Copayments

When choosing a Medicare plan, it’s important to consider costs like premiums, deductibles, and copayments. Premiums are the monthly fees you pay to have insurance. Deductibles are the amounts you pay out of pocket before Medicare begins to cover expenses. Being aware of these terms can make a significant difference in choosing the right plan. Additionally, it’s crucial to compare the benefits and limitations of each plan type. Copayments are the amounts paid for each service or prescription, often after the deductible is met. Medicare premiums can vary based on income and the specific plan. Understanding these cost components helps manage your budget and anticipate healthcare expenses, empowering you to make more informed decisions regarding your coverage.

Factors to Consider When Choosing a Medicare Plan

Choosing a Medicare plan requires evaluating multiple factors to ensure the plan suits your personal health needs and budget. Consider your current and anticipated healthcare needs, preferred healthcare providers, and any existing medications. Reviewing the formulary, or list of covered drugs, can save costs if prescriptions are necessary. It’s important to thoroughly understand all costs involved to avoid unexpected expenses later. Moreover, ensure you are aware of any enrollment deadlines to prevent being left without coverage. Evaluate the network of hospitals and doctors covered and check whether your preferred providers are included. Additionally, compare out-of-pocket maximums, premiums, and additional benefits such as dental, vision, or hearing, to determine what aligns best with your needs.

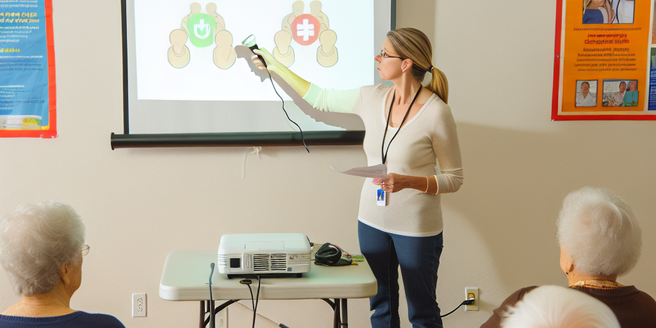

Expert Tips for Making an Informed Decision

To make an informed decision about Medicare plans, consider consulting with experts like Medicare advisors, or using resources such as the official Medicare website and local health insurance counseling programs. They can provide personalized advice based on your unique circumstances. Additionally, attending informational workshops can be a valuable way to stay informed about the latest updates and options in Medicare coverage. It’s also beneficial to review plan ratings and user experiences to understand real-world satisfaction and performance. Reassess your healthcare requirements annually during the open enrollment period to ensure your current plan continues to meet your evolving needs. Taking a proactive approach ensures you’re making the best decision for your healthcare coverage.