Common Health Insurance Challenges

Health insurance can present numerous challenges, including understanding one’s coverage and managing unexpected costs. One frequent issue is the complexity of insurance plans, which can make it difficult for policyholders to know what services are covered. Another challenge is the variability in coverage options which can create gaps leaving individuals exposed to unforeseen medical expenses. Additionally, rising premiums and out-of-pocket costs can strain finances, making it tough for families to afford essential care. Understanding network restrictions also poses difficulties, as some plans limit access to preferred healthcare providers. To address these challenges, consumers should thoroughly review their policies, seek clarification from insurers, and consider consulting a healthcare advocate or financial advisor for guidance.

Understanding Policy Terminology

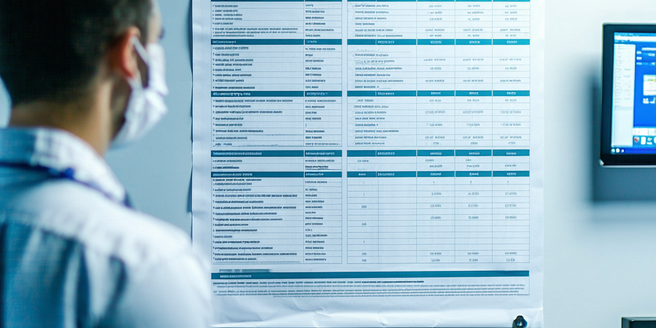

When dealing with health insurance, it is crucial to comprehend the policy terminology to make informed decisions. Terms such as premiums, deductibles, co-pays, and out-of-pocket maximum can initially seem daunting but are essential for evaluating a plan’s financial implications. A premium is a regular payment made to maintain coverage, while a deductible is the amount paid out-of-pocket before insurance kicks in. Co-pays are fixed fees for services, and out-of-pocket maximum is the limit on what one would spend in a year. Understanding these terms enables policyholders to better anticipate costs and compare different plans effectively. Educating oneself on these basics can lead to a more strategic selection of insurance options that align with healthcare needs and financial circumstances.

Navigating Coverage Limitations

Understanding the limitations of a health insurance policy is essential for effectively managing healthcare. Many plans have coverage limits that may not fully support certain treatments or services, leaving individuals responsible for significant expenses. Policyholders should be proactive in identifying these restrictions to avoid surprise costs. Reviewing the policy’s detailed explanation of benefits can help illuminate what services are excluded or subject to higher out-of-pocket fees. Common areas with coverage limitations include specialized treatments, elective procedures, and certain prescription drugs. Knowing these limitations in advance allows individuals to plan accordingly, seek alternative treatments, or arrange financing if necessary. Engaging with insurance providers to clarify uncertainties can also be beneficial.

Addressing Premium Increases

Health insurance premiums tend to rise annually, creating financial pressure for policyholders. Understanding why these increases occur and exploring strategies to manage them is important. Factors affecting premium hikes include rising healthcare costs, changes in the healthcare system, and adjustments based on age or geographic area. To address this, policyholders can shop around for more competitive rates, negotiate with current providers, or adjust their coverage levels to better fit their budget. Additionally, some employers offer wellness programs that can lead to discounts on premiums. Staying informed about changes in the healthcare market can also aid in anticipating premium shifts and preparing accordingly.

Resolving Claims Denials

Dealing with denied insurance claims is a frustrating experience that requires persistence and knowledge of the appeals process. Claims can be denied for various reasons, including incorrect coding, inadequate documentation, or policy exclusions. To resolve denials, policyholders should first carefully review the explanation of benefits to understand the reason for denial. Gathering any required supporting documents and resubmitting the claim with corrections can often resolve the issue. If necessary, an appeal can be filed, outlining the rationale for overturning the decision, supported by medical necessity documentation or expert opinions. Utilizing a healthcare advocate or contacting the insurance company’s customer service can also facilitate a quicker resolution.

Enhancing Your Health Plan Benefits

Maximizing the benefits of a health plan requires strategic utilization of available resources. Many plans offer wellness initiatives, preventive care services, and discounts that policyholders might overlook. Engaging in wellness programs can lead to better health outcomes and potential premium discounts. Taking advantage of preventive care services, often fully covered, is a proactive approach to maintaining health and avoiding costly treatments later. Evaluating and effectively using all available benefits, such as telemedicine options or health savings accounts, can improve the use of a health plan. Knowing which services are included in a plan enables individuals to fully leverage their insurance and derive maximum value from their coverage.