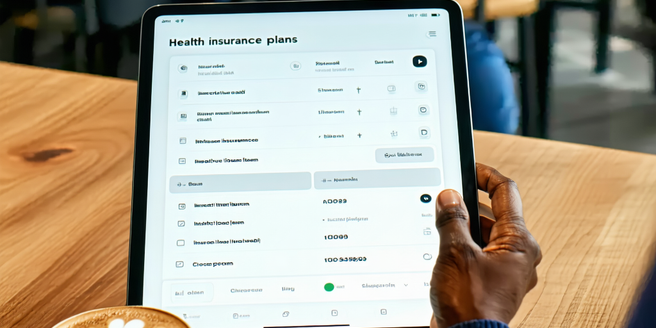

Understanding Online Health Insurance Portals

| Feature | Description | Benefits |

| Plan Selection | Choose from various plans | Multiple options for diverse needs |

| Comparison Tools | Side-by-side analysis of plans | Informed decision-making |

| Policy Management | Manage your policy online | Convenience and control |

| Claims Tracking | Monitor your claim status | Transparency in claim handling |

| Renewal Reminders | Automated alerts for renewals | Never miss a renewal date |

| Customer Support | 24/7 assistance chat/call | Timely help and problem-solving |

Convenience of Access Anytime, Anywhere

Online health insurance portals provide unmatched convenience by allowing users to access their accounts anytime and from anywhere. These platforms break the barriers of traditional office hours and locations, giving customers the freedom to manage their health insurance needs at their own pace. The easy-to-use interfaces are designed to facilitate quick navigation, ensuring that users can find what they need without hassle. This approach not only saves time but also enhances user satisfaction as they have everything they need at their fingertips, whether they are at home, at work, or on the go. This level of accessibility is particularly beneficial for busy individuals who may not have the time to visit physical offices. In this digital age, having constant access to important information empowers users to be proactive about their health insurance management.

Comprehensive Plan Comparison at Your Fingertips

One of the major advantages of online health insurance portals is the ability to compare plans comprehensively in one place. These platforms offer sophisticated comparison tools that allow users to evaluate different plans based on coverage, premiums, deductibles, and other critical factors. Such features are invaluable for making informed decisions, enabling users to choose the plan that best meets their individual or family needs. Instead of visiting multiple agents or companies, customers can get all the necessary information with a few clicks. This process not only increases transparency but also boosts confidence in the decision-making process. With visual aids and simplified data representations, users can better understand the nuances of each plan, leading to more personalized and satisfactory choices in their health insurance journey.

Seamless Policy Purchase and Renewal Process

Online health insurance portals streamline the often cumbersome process of purchasing and renewing policies. The user-friendly design and clear instructions guide users through each step, from selecting a plan to completing the purchase. For renewals, users receive timely reminders, ensuring they never miss a critical deadline. This automation reduces manual effort and errors, providing peace of mind for policyholders. By integrating secure payment gateways, these portals ensure that transactions are safe and hassle-free. Additionally, online systems can store and update user information, making renewals or policy changes quick and efficient. The streamlined process significantly reduces the time and effort involved in managing health insurance, allowing users to focus more on their health needs rather than administrative tasks.

User-Friendly Interfaces Tailored for All Ages

Online health insurance portals are designed with interfaces that are intuitive and user-friendly, catering to users across different age groups. Whether a tech-savvy millennial or a senior looking for an easy online experience, these platforms offer simplified navigation and clear instructions. The layout and design are focused on enhancing user experience, providing easy access to key features and services. Language options, font size adjustments, and other accessibility features further enhance inclusivity and ease of use. By prioritizing accessibility, digital platforms ensure that all users can confidently manage their health insurance needs without feeling overwhelmed or intimidated by technology. This approach encourages more users, who might have otherwise resisted digital channels, to embrace the convenience and efficiency of online portals.

Enhanced Security for Your Personal Information

In the digital age, security is a paramount concern, especially when handling sensitive information like health insurance details. Online portals employ advanced security protocols to protect user data against unauthorized access and breaches. Encryption technologies and secure login processes ensure that personal and financial information remains confidential and secure. The assurance of data privacy fosters trust between users and service providers, making users more comfortable using online platforms. Additionally, regular security updates and compliance with industry standards offer an added layer of protection. Through rigorous security measures, online health insurance portals address potential risks, providing peace of mind to users so they can focus on managing their policies without worrying about data security.

Instant Access to Policy Details and Documents

With online health insurance portals, policyholders have instant access to all of their policy details and necessary documents with just a few clicks. This feature is particularly beneficial in situations where immediate proof of insurance or policy specifics are required, such as at a doctor’s office or in emergencies. Users can download, print, or share their documents instantly, offering convenience and flexibility that wasn’t possible with traditional insurance methods. This access to real-time information aids in planning healthcare needs and understanding the scope of coverage, helping users to avoid surprises or misunderstandings regarding their benefits. Overall, the ability to access up-to-date policy details at any time empowers users to take charge of their healthcare decisions confidently.

Personalized Recommendations Based on Your Needs

Online health insurance portals personalize the user experience by providing tailored recommendations based on individual needs and preferences. They have revolutionized the way consumers interact with insurance options. By analyzing user data such as demographics, health status, and previous policy choices, these platforms suggest plans and benefits that suit the user’s profile. This personalization saves users time and effort, ensuring that they receive advice and options that are truly relevant. The use of intelligent algorithms and data analytics enhances the accuracy of the recommendations, making the online experience not just convenient but also highly customized. Personalized assistance improves user satisfaction and encourages consumers to make well-informed, confident choices about their health insurance cover.

Real-Time Customer Support and Assistance

Real-time customer support is an invaluable feature of online health insurance portals, providing immediate assistance whenever needed. With options like live chat, emails, or dedicated phone lines, users can get answers to their queries or resolve issues without any delay. This rapid responsiveness ensures that users feel supported and valued, enhancing their overall experience. Additionally, this approach helps mitigate any potential frustrations users might encounter while navigating insurance processes. The availability of extensive FAQ sections and help centers further aids in addressing common concerns independently, streamlining the customer support process by reducing waiting times and queues associated with traditional methods. With a focus on delivering practical support promptly, online platforms foster stronger customer-provider relationships and build credibility with their user base.

Cost Savings Opportunities Through Digital Platforms

Online health insurance portals open up new avenues for cost savings, benefiting users by offering competitive pricing and exclusive digital deals. With the ever-growing presence of digital platforms, users find it easier than ever to stay informed about the latest insurance updates and offerings. The transparency and ease of comparing multiple plans encourage users to identify more affordable options that meet their requirements. Additionally, reduced operational costs for insurers when dealing directly with customers online result in lower premiums or added benefits passed on to the consumers. E-transaction facilities eliminate the need for paperwork and in-person consultations, further cutting down on expenses. These cost-effective measures make insurance more accessible and affordable for a broader audience, ultimately fostering greater financial security for users seeking quality healthcare solutions without correspondence-related inefficiencies.