High-impact Changes To Medicare Plans

Understanding the Basics of Medicare Plans Medicare is a federally funded program providing healthcare coverage to people aged 65 and older, or younger individuals with disabilities. It comprises different parts,…

Evaluating Health Insurance Networks

Understanding Health Insurance Networks: Basics and Definitions Health insurance networks are groups of healthcare providers contracted by insurers to deliver services to members at pre-negotiated rates. These networks can affect…

Medigap And Dental Coverage

Understanding Medigap: An Overview Medigap is a supplemental insurance policy designed to cover gaps left by traditional Medicare. It helps cover out-of-pocket expenses like copayments, coinsurance, and deductibles that Medicare…

Affordable Vision And Dental Insurance

Understanding the Basics of Vision and Dental Insurance Vision and dental insurance are designed to cover expenses associated with eye and dental care, offering financial relief for routine cleanings, exams,…

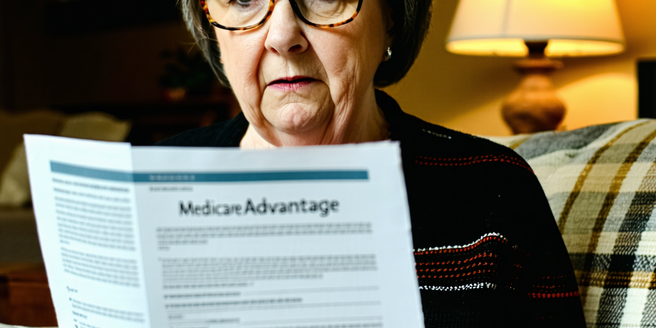

Understanding Medicare Advantage Plan Ratings

What Are Medicare Advantage Plans? Medicare Advantage Plans, also known as Medicare Part C, are an alternative to the traditional Medicare offered by private insurers. These plans cover all the…

Health Insurance Benefits Explained

Understanding Health Insurance Basics Health insurance can be complex, but understanding the basics is crucial. It involves a contract between you and an insurance provider to cover medical costs. This…

Medicare And Family Caregivers

Understanding Medicare Coverage Options for Families Medicare coverage options can be complex for families navigating healthcare choices. With various plans like Original Medicare, Medicare Advantage, and supplemental insurance, families must…

Evaluating Medigap Providers

Understanding What Medigap Is and How It Works Medigap, also known as Medicare Supplement Insurance, is an additional health insurance coverage that complements your original Medicare plan. It helps to…

Navigating Medicare Advantage Plans

Understanding the Basics of Medicare Advantage Plans Medicare Advantage Plans, known as Part C, are an alternative to traditional Medicare. They are offered by private companies approved by Medicare and…

Employer Health Insurance Options

Understanding the Basics of Employer Health Insurance Employer health insurance is a critical benefit offered by many companies. It helps employees gain access to healthcare services at reduced costs. Understanding…